Share this

Shipfusion Raises $40 Million in Growth Equity Funding

by Christie McLeod on Apr. 14, 2022

Shipfusion Secures $40 Million in Growth Equity Funding from Kayne Anderson Capital Advisors

Today we announce a $40.0 million USD growth equity investment from Kayne Partners, the growth private equity group of Kayne Anderson Capital Advisors. The latest financing comes as we further accelerate our growth and global expansion to support more customers with new strategic warehouse locations, along with advanced technology enhancements to our platform. As part of this round of financing, Leon Chen of Kayne Partners will join Shipfusion’s Board of Directors.

According to the US Department of Commerce, total eCommerce sales for 2021 were estimated at $870.8 billion, an increase of 14.2 percent from 2020. As eCommerce volumes continued to grow, so did the need for technology-driven shipping and fulfillment. This industry momentum allowed us to continue on our rapid growth trajectory, which saw our revenue more than triple since the start of the pandemic.

“ECommerce merchants need powerful technology to integrate their sales channels and inventory management systems, combined with meticulous warehouse execution that allows for flexibility and customization,” says Brandon Luft, Shipfusion’s CEO and Co-Founder. “In building out our own proprietary software as well as our own strategic warehouse network throughout North America, Shipfusion has been in a position to execute on both fronts, creating an unrivaled fulfillment experience.”

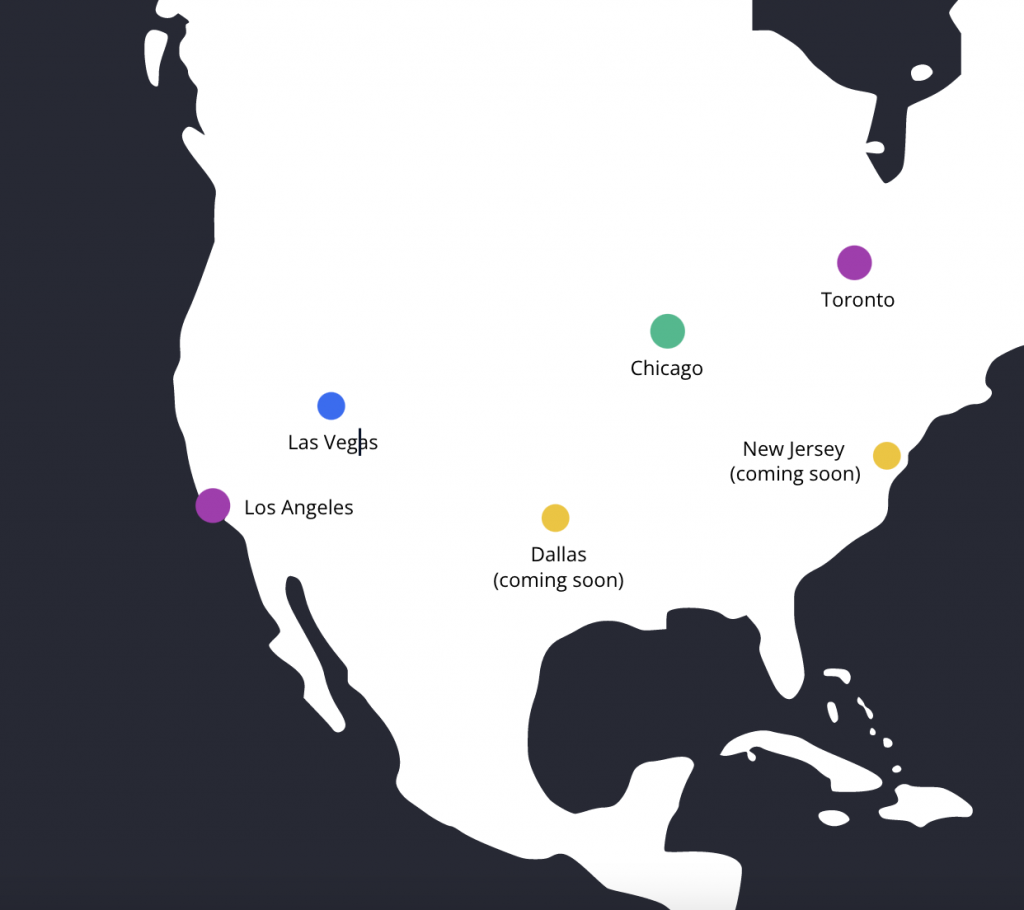

In addition to established distribution centers in Chicago, Los Angeles, and Toronto, we recently announced the launch of our 250,000+ square foot warehouse in Las Vegas, a growing hub for many leading logistics companies in North America. All facilities are operated by Shipfusion and powered by our proprietary warehouse management systems. In addition to being a leader in D2C fulfillment, Shipfusion has also built robust technology around B2B fulfillment, partnering with EDI integrators such as SPS Commerce.

“By focusing on both D2C and B2B channels, Shipfusion is in an ideal position to service high volume eCommerce brands that are pursuing both avenues for growth,” said Jared Cantor, Shipfusion’s Chief Operating Officer. ” We have seen many of our client’s scale in size and require B2B capabilities. This led us to build out our wholesale offering, allowing clients to fulfill any size order to a variety of customers.”

While Shipfusion services clients across a range of verticals, we have invested heavily in the health & supplement fulfillment market, offering temperature-controlled storage, special handling certifications, end-to-end lot tracking, and FDA-registered facilities.

We first opened our doors in 2014, making Shipfusion one of North America’s first eCommerce-based fulfillment companies to develop our own technology. Founders Brandon Luft and Michael Stock both saw the impending opportunity in the eCommerce space.

According to Stock, “We saw a massive wave of eCommerce volume starting to build, but limited options when it came to eCommerce enablement and technology. We felt shipping and fulfillment were going to be critical to scaling eCommerce companies and sensed an opportunity to start building out solutions.”

MICHAEL STOCK, SHIPFUSION’S CTO

Shipfusion bootstrapped its growth over the first few years, focusing on building out our core product and ensuring Shipfusion’s foundation was rooted in healthy financial metrics. “The last thing we wanted to do was burn unnecessary capital in the early years by pursuing revenue for the sake of it – we felt that bootstrapping would establish proper discipline in the company and ultimately give us the most options down the road with investors or potential acquirers,” says Luft. “Kayne Capital is an ideal partner due to their large success in both technology and supply chain investments, but more importantly, because we share similar perspectives on “healthy” growth.”

“Shipfusion solves fundamental pain points for the eCommerce shipping and fulfillment industry, in a fast-growing but deeply fragmented market,” says Leon Chen, Managing Partner at Kayne Partners. “Shipfusion has cemented itself as a critical solution for small and mid-sized retailers needing to navigate a quickly evolving and highly complex landscape. We are extremely excited to partner with the company and leverage the resources of Kayne Partners to grow the business into a clear market leader.”

About Kayne Partners: Kayne Partners, the Los Angeles-based dedicated growth private equity group of Kayne Anderson Capital Advisors, L.P., leverages its large firm resources to partner and invest in lower middle market, privately held, high growth, enterprise software and tech-enabled service businesses across North America. The team has developed a durable and repeatable investment strategy and process for applying its stage expertise through sourcing and investing in companies at an early inflection point, adding value and scaling through organic growth and M&A, and exiting these must-have assets to strategics & financial sponsors. The team has experience investing across media & telecommunications, supply chain & logistics, financial technology, healthcare IT, security & compliance, and business process outsourcing and automation. For more information, please visit kaynepartners.com.

About Kayne Anderson Capital Advisors: Kayne Anderson Capital Advisors, L.P., founded in 1984, is a leading alternative investment management firm focused on real estate, credit, infrastructure/energy, renewables, and growth equity. Kayne’s investment philosophy is to pursue niches, with an emphasis on cash flow, where our knowledge and sourcing advantages enable us to deliver above average, risk-adjusted investment returns. As responsible stewards of capital, Kayne’s philosophy extends to promoting responsible investment practices and sustainable business practices to create long-term value for our investors. Kayne manages $32 billion in assets (as of 2/28/2022) for institutional investors, family offices, high net worth and retail clients and employs 320 professionals in five core offices across the U.S. For more information, please visit kaynecapital.com.

Goodmans LLP and Cascadia Capital acted as advisors to Shipfusion on this transaction.

Share this

You May Also Like

These Related Articles

Shipfusion Turns 7

Shipfusion Expands Partnership with Shopify, joins Shopify Plus Certified App Program

Shipfusion named one of Canada’s Top Growing Companies by The Globe and Mail’s 2022 Report on Business

- April 2025 (9)

- March 2025 (26)

- February 2025 (26)

- January 2025 (37)

- December 2024 (16)

- November 2024 (23)

- October 2024 (22)

- September 2024 (27)

- August 2024 (9)

- July 2024 (8)

- June 2024 (5)

- May 2024 (8)

- April 2024 (8)

- March 2024 (6)

- February 2024 (6)

- January 2024 (5)

- December 2023 (3)

- November 2023 (3)

- October 2023 (5)

- September 2023 (4)

- August 2023 (2)

- July 2023 (1)

- June 2023 (4)

- March 2023 (2)

- October 2022 (1)

- September 2022 (5)

- August 2022 (4)

- July 2022 (7)

- June 2022 (4)

- May 2022 (4)

- April 2022 (6)

- March 2022 (2)

- February 2022 (1)

- January 2022 (3)

- December 2021 (2)

- November 2021 (4)

- October 2021 (2)

- September 2021 (5)

- August 2021 (4)

- July 2021 (4)

- June 2021 (3)

- May 2021 (2)

- April 2021 (3)

- March 2021 (3)

- February 2021 (3)

- January 2021 (2)

- December 2020 (4)

- November 2020 (2)

- October 2020 (4)

- September 2020 (2)

- July 2020 (5)

- June 2020 (4)

- May 2020 (2)

- April 2020 (2)

- March 2020 (4)

- February 2020 (1)

- December 2019 (1)

- May 2018 (1)

- March 2018 (2)

- February 2018 (3)

- January 2018 (3)

- November 2017 (3)

- July 2017 (4)

- March 2017 (3)

- February 2017 (5)

- January 2017 (3)

- December 2016 (4)

- November 2016 (6)

- October 2016 (6)

- October 2015 (1)

- September 2015 (1)

- June 2015 (3)

- May 2015 (3)

- August 2014 (1)

- July 2014 (1)

- March 2014 (1)

- February 2014 (1)